Get Started

First, please watch this 80 second video - an overview to creating your integration:

"Awesome, but how do I set up step 4 of my pipe?"

Good question. Here's a walkthrough of our default settings for Xero.

Note: they are very similar to QuickBooks Online:

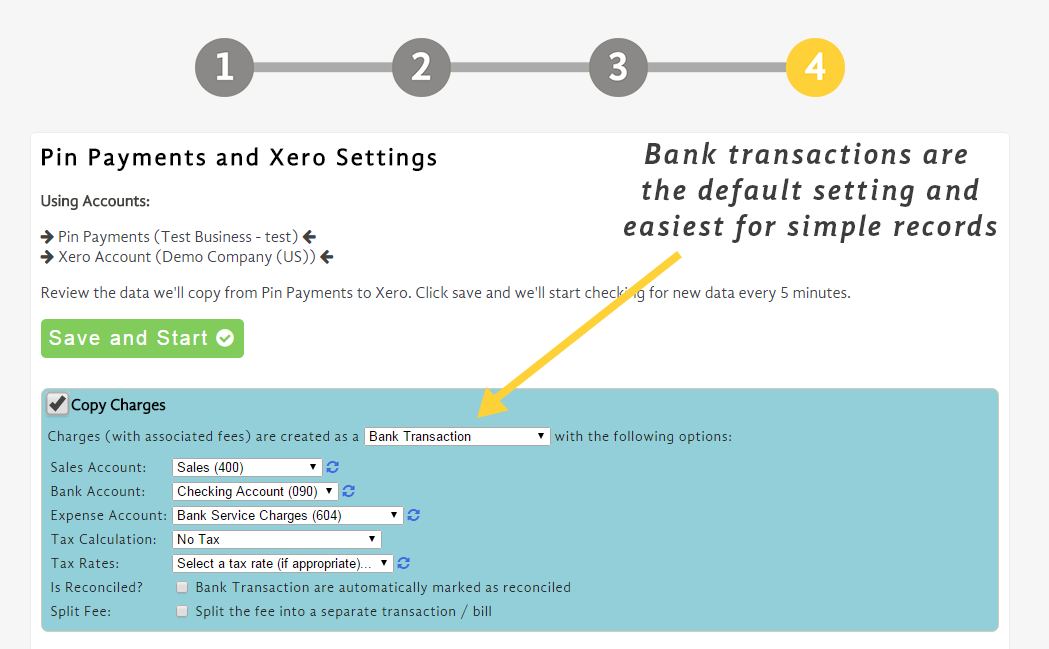

Step 4 is the most complicated section. Let's go over the basic settings.

Let's look at the "Charges" section first.

Bank Transactions are our default setting in Xero: it's the easiest to use. Here's some info on the different settings associated with this feature.

QuickBooks Online users: These will default as "Sales Receipts" - the associated accounts are all the same.

- Sales Account: This is where we record gross sales.

- Bank Account: This is the bank account where the payment gateway will deposit your net income from the sale.

- Expense Account: We will place the fee amount that the payment gateway charges in this expense account.

- Tax Calculation: Were there any relevant taxes? Select the appropriate calculation (ie: "GST").

- Tax Rate: What percentage is the tax calculation (if applicable).

- Is Reconciled?: This function will automatically mark the charge as reconciled in Xero. If you receive consistent income from the payment gateway and do not need to reconcile by hand this can save you time.

- Split Fee: We can split the payment gateway fee into a separate transaction if you do not like it combined as one transaction.

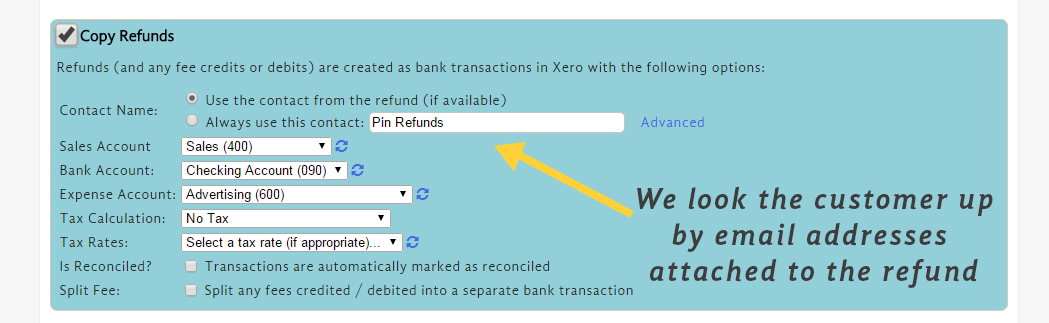

Next are the "Refunds".

All of these accounts should be the same as your "charges" section.

- Sales Account: We will remove the refunded amount from sales

- Bank Account: We will remove the net income from the sale.

- Expense Account: If the fee is refunded we will remove the fee amount, .

- Tax Calculation: Were there any relevant taxes? Select the appropriate calculation (ie: "GST").

- Tax Rate: What percentage is the tax calculation (if applicable).

- Is Reconciled?: Automatically mark the charge as reconciled in Xero. If your refunds are consistent from the payment gateway and you don't need to reconcile by hand this can save you time.

- Split Fee: We can split the payment gateway fee into a separate transaction if you do not like it combined as one transaction.

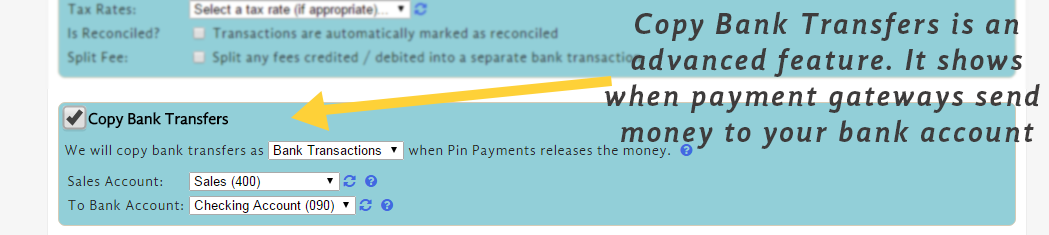

Last are "Copy Bank Transfers".

This is an advanced feature. You will need to create a "holding account" in Xero to hold the income that hasn't been transferred to your bank account yet. When the payment gateway processes a card the money does not immediately transfer to your bank. This feature shows you pending transfers of funds you are waiting on.

- Sales Account: The "holding account" you created

- Bank Account: Select the same bank account from Charges/Refunds

Okay, so my accounts are all set up... what will my data look like?

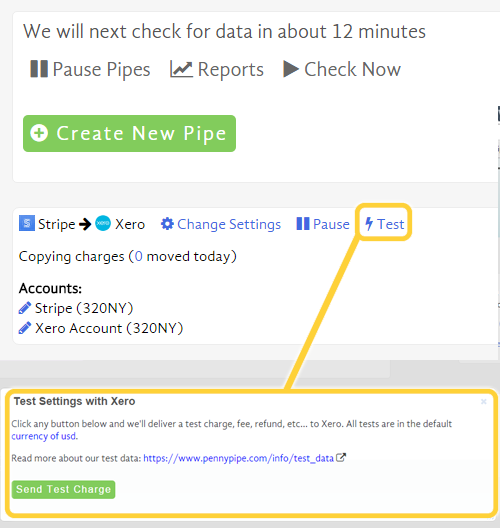

Try our "test" button after you create your pipe. Alternatively, there are some screenshots below.

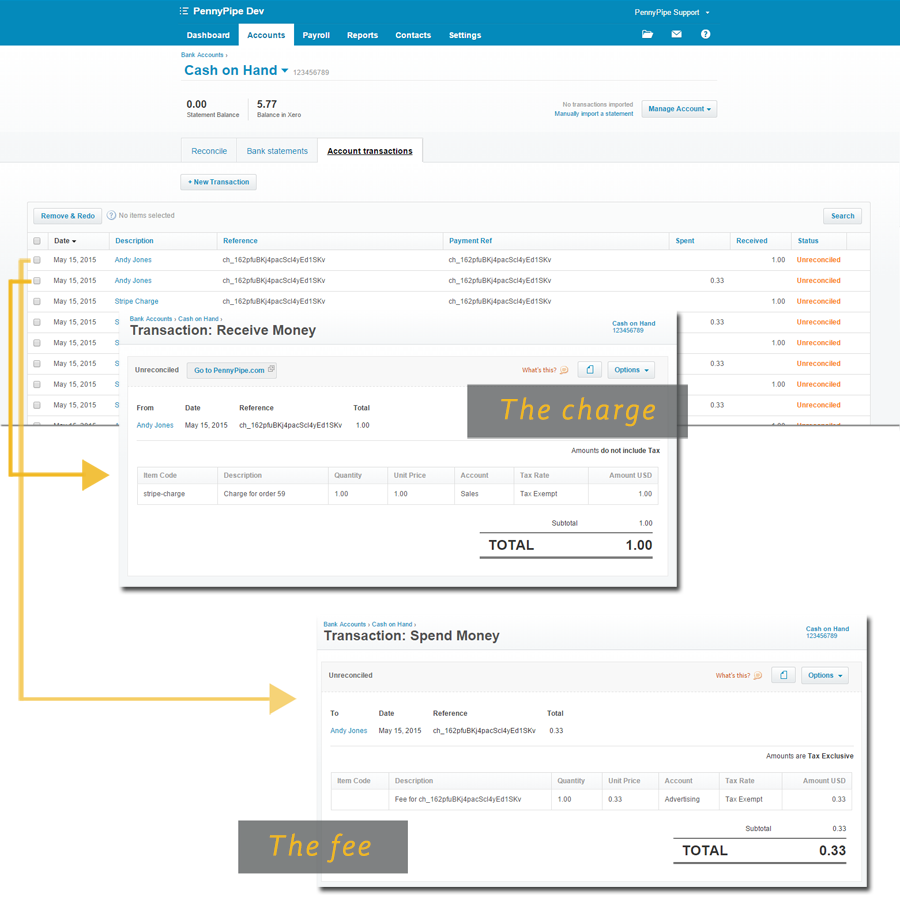

This is a bank feed in Xero where PennyPipe has added a charge and a fee:

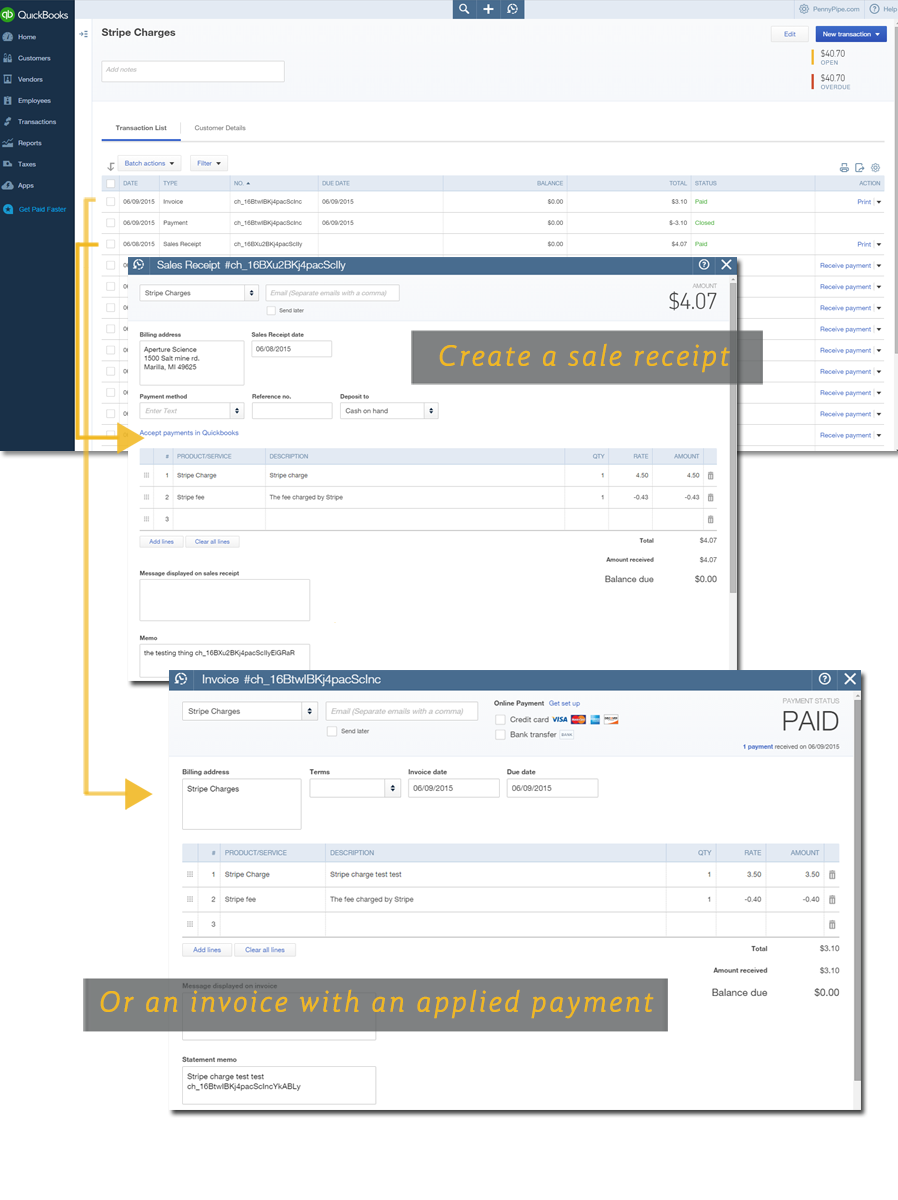

This is an activity log in QuickBooks Online for the customer "Stripe Charges". PennyPipe can add a sales receipt, create an invoice with an applied payment, or apply a payment to an existing invoice. Samples are shown here: