PennyPipe integrates Pin Payments

with your accounting software

Syncs charges, refunds, and fees as bank transactions or create new invoices & applied invoice payments in Xero

Syncs charges as sales receipts or invoices & fees as expenses in QuickBooks Online.

Sends Pin Payments charge, fee, and refund data to RJMetrics for analysis.

Automatically separates Pin Payments fees as an expense.

Updates every 5 minutes: See your transactions in real-time.

Weekly reports show what type of data was moved and when.

"Great, but how do I set up my pipe?"

Good question. Here's a walkthrough of our default settings for Xero:

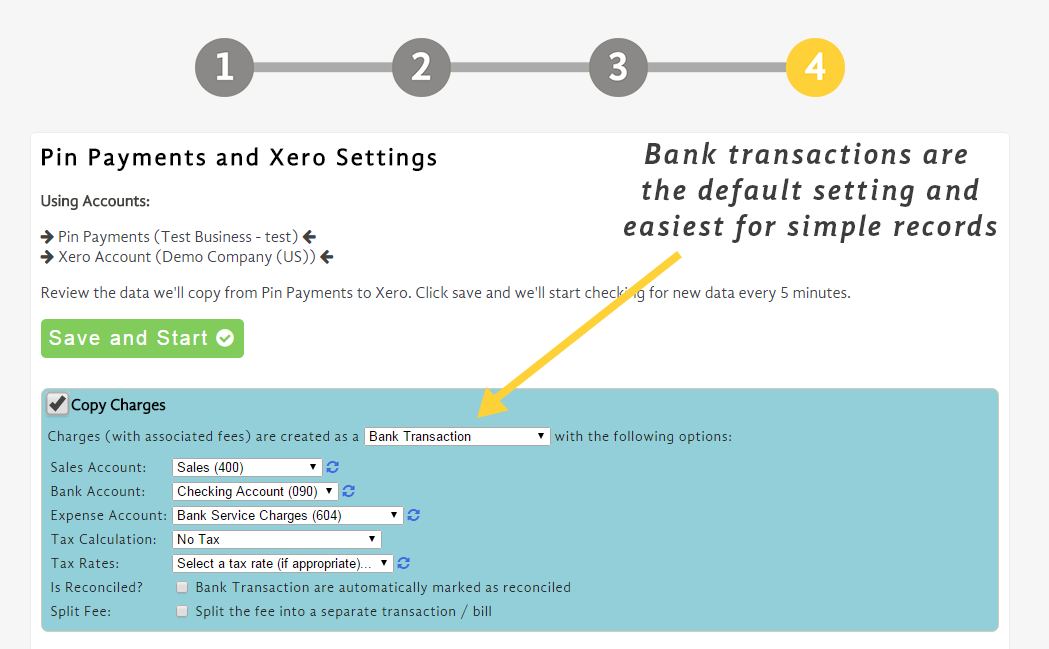

Let's go over the most complicated section: step 4.

We'll deal with the "Charges" section first.

Bank Transactions are our default setting because it's the easiest to use. Here's some info on the different settings associated with this setting.

- Sales Account: This is where we record gross sales.

- Bank Account: This is the bank account where Pin Payments will deposit your net income from the sale.

- Expense Account: We will place the fee amount that Pin Payments charges in this expense account.

- Tax Calculation: Were there any relevant taxes? Select the appropriate calculation (ie: "GST").

- Tax Rate: What percentage is the tax calculation (if applicable).

- Is Reconciled?: This function will automatically mark the charge as reconciled in Xero. If you receive consistent income from Pin Payments and do not need to reconcile by hand this can save you time.

- Split Fee: We can split the Pin Payments fee into a separate transaction if you do not like it combined as one transaction.

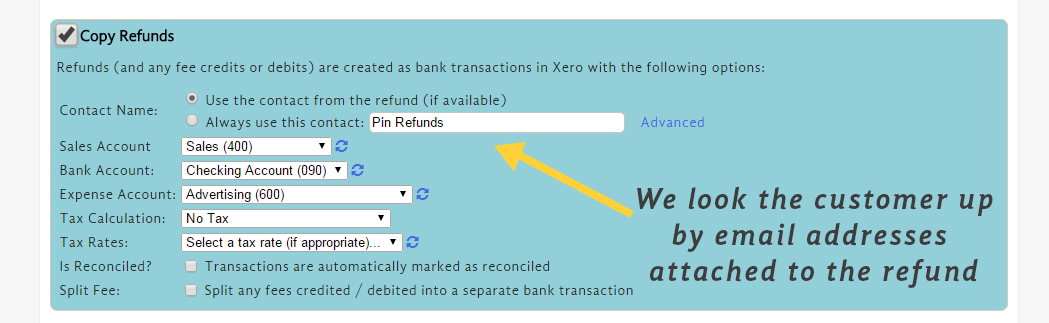

Next are the "Refunds".

All of these accounts should be the same as your "charges" section.

- Sales Account: We will remove the refunded amount from sales

- Bank Account: We will remove the net income from the sale.

- Expense Account: If the fee is refunded we will remove the fee amount, .

- Tax Calculation: Were there any relevant taxes? Select the appropriate calculation (ie: "GST").

- Tax Rate: What percentage is the tax calculation (if applicable).

- Is Reconciled?: Automatically mark the charge as reconciled in Xero. If your refunds are consistent from Pin Payments and you don't need to reconcile by hand this can save you time.

- Split Fee: We can split the Pin Payments fee into a separate transaction if you do not like it combined as one transaction.

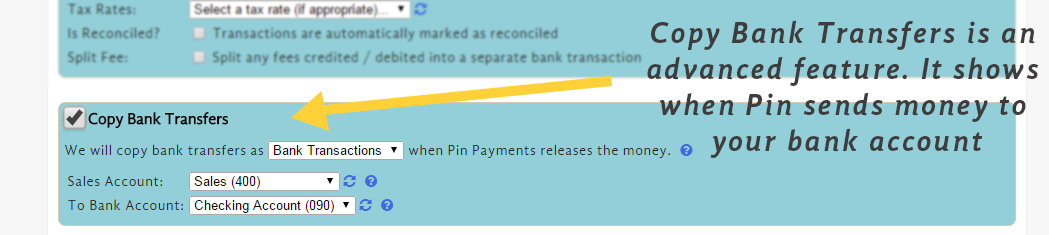

Last are "Copy Bank Transfers".

This is an advanced feature. You will need to create a "holding account" in Xero to hold the income that hasn't been transferred to your bank account yet. When Pin Payments processes a card the money does not immediately transfer to your bank. This feature shows you pending transfers of funds you are waiting on.

- Sales Account: The "holding account" you created

- Bank Account: Select the same bank account from Charges/Refunds

Thanks for checking PennyPipe out, still not convinced?

Give us a call at +1 888-404-2904 or email support@pennypipe.com and we'll tell you why we're the best.